Welcome to the Turning 65 Workshop!

MEET Your Medicare advisos

Hey, We are SBI Benefits!

We are licensed Medicare Advisors dedicated to helping people confidently navigate Medicare and insurance in general as you Turn 65.

Our goal is simple — make it easy to understand your options, avoid costly mistakes, and ensure your coverage actually works for you.

Over time, we've helped countless clients find clarity and peace of mind by focusing on:

Straightforward explanations (no confusing jargon)

Honest recommendations based on your situation

Fast, reliable support when you need it most (We are here to help!!)

We've helped countless folks out just like you,

see what they have to say

What you need to know about Medicare before you make any decisions

This short, step-by-step guide is designed to help you understand how Medicare works, what choices you’ll need to make, and how to avoid common (and costly) mistakes.

This guide should take you about 15-20 minutes to work through. We guarantee if you go through the entire thing you'll feel much more confident about your upcoming Medicare coverage!

What We’ll Walk Through Together

What is Original Medicare

How and when to enroll

What Medicare Doesn't Cover

The Two Ways To Structure Your Medicare Coverage

How umbrella package coverage helps close the gaps

Prescription Drug Coverage

How working with an advisor helps

This guide is educational only. There’s no obligation to enroll in anything.

If at any point you’d like help reviewing your personal situation, you can speak with a licensed Medicare advisor but only if and when you choose.

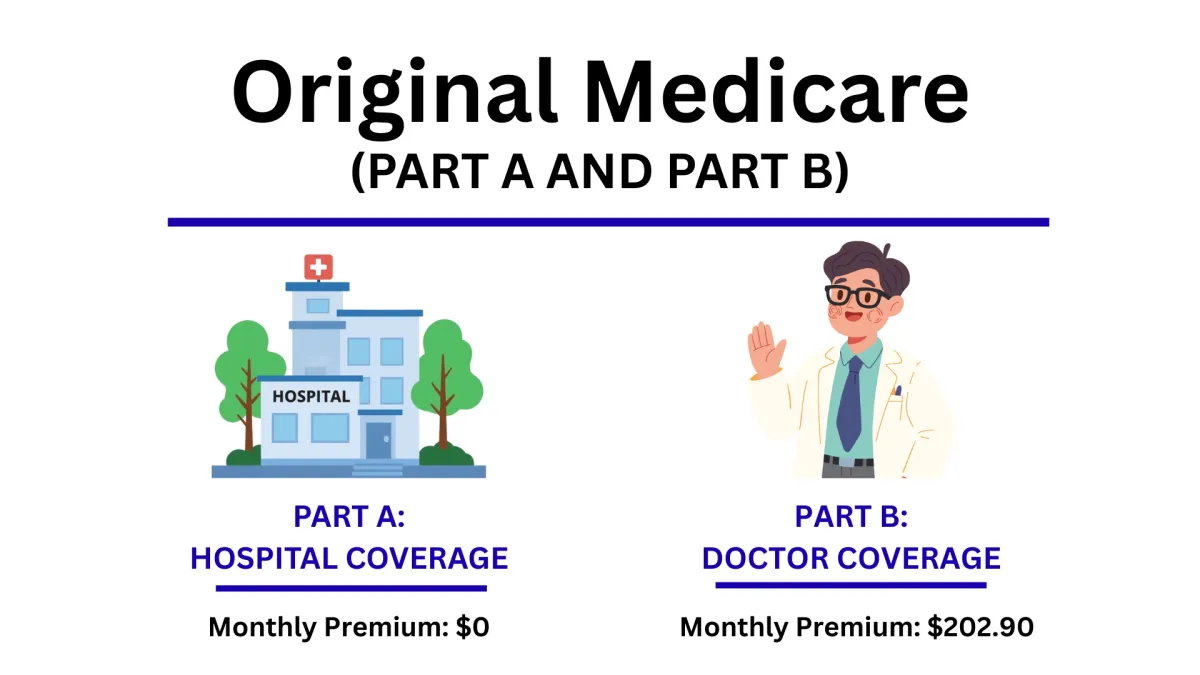

Part One: Original Medicare

Let's Start With the Basics

Medicare is made up of different “parts,” and understanding the first two is the foundation for everything else.

Most people enroll in Original Medicare, which includes Part A and Part B.

Medicare Part A

Hospital Coverage

Part A helps cover care when you’re admitted to a hospital or facility

Inpatient hospital stays

Skilled nursing facility care (after a hospital stay)

Hospice care

Limited home health care

For most people, Part A has no monthly premium if you’ve worked and paid Medicare taxes long enough.

Medicare Part B

Doctor & Medical Coverage

Part B helps cover everyday medical care, such as

Doctor visits

Outpatient services

Lab work and diagnostic tests

Preventive care

Durable medical equipment

Unlike Part A, Part B does have a monthly premium. For most people, this premium is set by Medicare and is paid monthly.

Important to Know

Medicare Part A and Part B work together, but they do not cover everything.

Later in this guide, we’ll walk through what Medicare does not cover — and how many people choose to handle those gaps.

Questions Already?

You can talk with a licensed Medicare advisor anytime if you’d like help reviewing how this applies to your situation.

Next, let’s look at when and how you actually enroll, because the rules change depending on your situation.

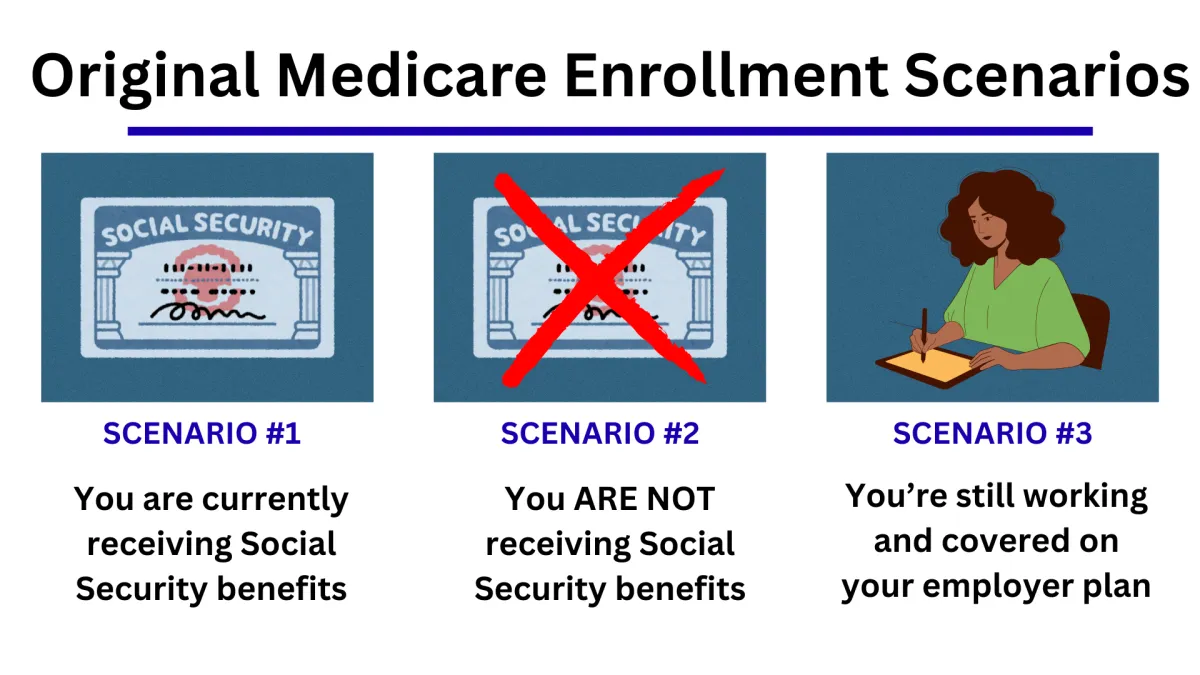

Part Two: When & How You Enroll in Medicare

Scenario 1

You’re Already Receiving Social Security

If you’re already receiving Social Security benefits:

You are automatically enrolled in Medicare Part A and Part B

Your Medicare card is typically mailed about 3 months before your 65th birthday

Your Part B premium is usually deducted from your Social Security check

Limited home health care

For many people, this is the simplest enrollment path — but you still need to review your coverage options.

Scenario 2

You Are Not Receiving Social Security

If you’re not receiving Social Security yet:

You must actively enroll in Medicare yourself

Enrollment can be done

- Online through Social Security

- By phone

- In person at a Social Security office

Part B premiums are typically billed quarterly

Your Part B premium is usually deducted from your Social Security check

This is a common area where people accidentally delay enrollment or miss important steps.

Scenario 3

You’re Still Working Past Age 65

If you’re still working and covered by an employer plan:

You may be able to delay Part B without penalty

Timing matters and depends on:

- Employer size

- Type of coverage you have

When you retire, you’ll need to enroll correctly to avoid penalties or gaps

This scenario often requires a quick review to make sure everything lines up properly.

When Does Coverage Start?

For most people, Medicare coverage begins:

The first day of your birthday month, if you enroll on time

Earlier or later depending on when you apply and your situation

Getting the timing right is critical to avoid coverage gaps or late penalties.

Not sure which scenario applies to you?

A licensed Medicare advisor can help confirm you’re enrolling the right way.

Next, let’s look at what Medicare doesn’t cover — and why that’s important to understand before choosing a plan.

Part Three: What Medicare Doesn’t Cover (and Why That Matters)

Medicare Works — But It Doesn’t Cover Everything

Original Medicare (Part A and Part B) was never designed to cover everything.

It’s meant to be a base layer, not complete protection.

Understanding where Medicare stops paying is important especially before choosing how to structure the rest of your coverage.

Common Cost Gaps to Be Aware Of

Hospital Costs Under Medicare (Part A)

Medicare Part A helps cover hospital care, but it does not cover unlimited stays.

You pay a deductible for each hospital benefit period

Medicare covers a limited number of inpatient days

Longer stays can result in daily costs adding up quickly

Coverage is reset based on benefit periods, not calendar years

For short stays, this may not be an issue.

For longer or repeated hospitalizations, out-of-pocket costs can increase.

Doctor & Outpatient Costs (Part B)

Medicare Part B covers things like:

Doctor visits

Outpatient procedures

Lab work and testing

Preventive services

However, with Part B:

Medicare typically pays 80% of approved charges

You are responsible for the remaining 20%

There is no annual out-of-pocket maximum

This means costs can vary depending on how often you need care.

Excess Charges (Often Overlooked)

Some doctors are allowed to charge more than the Medicare-approved amount.

When this happens:

Medicare pays its portion

You may be responsible for the additional amount

Many people aren’t aware this is even possible but it’s one of the reasons coverage choices matter.

Skilled Nursing Facility Coverage

Medicare provides limited skilled nursing coverage following a hospital stay.

Medicare covers care for a set number of days

After that, daily costs can apply

Once coverage ends, you are responsible for all remaining costs

This often surprises people who assume skilled nursing is fully covered.

Cancer & Serious Illness Expenses

Even with Medicare, serious illnesses like cancer can bring out-of-pocket expenses, including:

Treatment-related costs Medicare doesn’t fully cover

Travel, lodging, or recovery-related expenses

Coinsurance and deductibles over time

This is why some people choose to explore additional protection options depending on their health and budget.

Why This Matters

None of this means Medicare is inadequate it means planning matters.

Most people want predictable costs in retirement with no surprises during medical events

and prefer understanding their options before enrolling.

Knowing these gaps ahead of time helps people make informed decisions instead of rushed ones later.

This is where Medicare planning comes in.

A licensed Medicare advisor can help explain how people typically manage these gaps based on their needs.

Next, let’s look at the two main ways people structure their Medicare coverage to help manage these costs — and how they’re different.

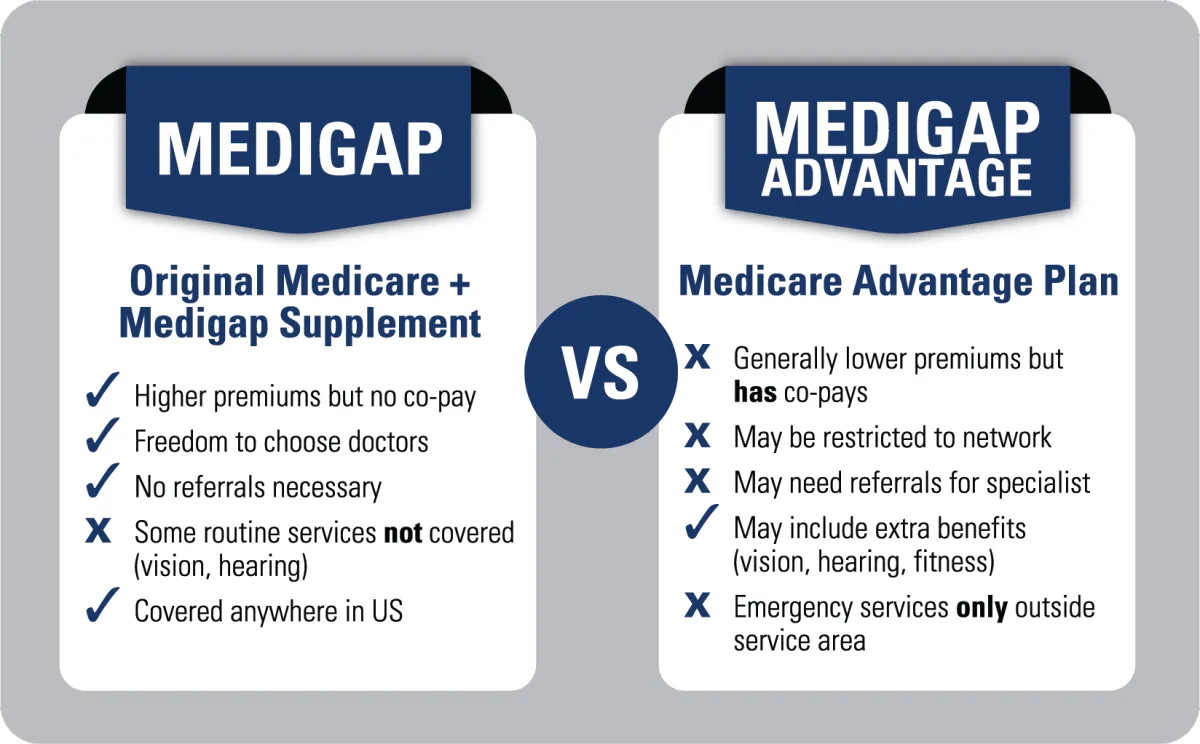

Part Four: The Two Main Ways People Structure Medicare Coverage

There Are Two Primary Medicare Paths

Once you understand how Medicare works and where the gaps are, most people choose one of two main paths to structure their coverage.

There isn’t a “better” option overall. The right choice depends on your preferences, budget, and how you want your healthcare to work.

Your Two Options

Medicare Supplement (Medigap)

A Medicare Supplement works alongside Original Medicare.

How it generally works:

You keep Original Medicare (Part A & Part B)

A supplement helps cover many of Medicare’s out-of-pocket costs

You can see any doctor nationwide who accepts Medicare

No referrals needed

Why some people prefer this path:

More predictable medical costs

Broad provider access

Simpler experience when traveling or seeing specialists

Things to consider:

Monthly premiums are usually higher

Prescription drug coverage is handled separately

Medicare Advantage (Part C)

Medicare Advantage plans are offered by private insurance companies and replace Original Medicare as your primary coverage.

How it generally works:

Why some people prefer this path:

Lower monthly cost

Extra benefits may be included (such as dental, vision, or fitness)

Things to consider:

Networks may be more limited

Copays and costs vary as you use care

Referrals may be required for specialists

The Tradeoff to Understand

Most people choose based on one key preference

Predictability & flexibility → Medicare Supplement

Lower monthly cost & bundled coverage → Medicare Advantage

Neither choice is wrong, it’s about what fits your situation best.

Most people talk this through before deciding.

A licensed Medicare advisor can help compare these options based on your doctors, budget, and preferences.

Next, let’s look at how people often add an extra layer of protection, sometimes called “umbrella coverage” to help manage bigger medical expenses.

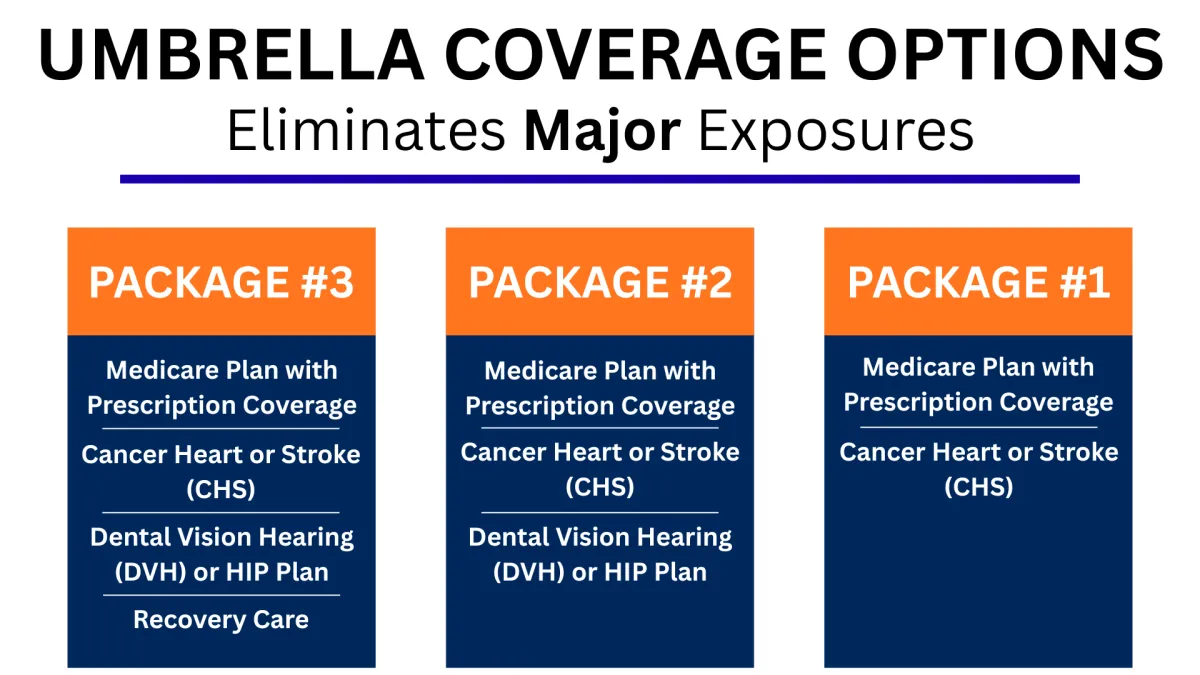

Part Five: Umbrella Coverage

An Extra Layer of Protection

Medicare Covers a Lot — But Not Everything at Once

Even after choosing Medicare Supplement or Medicare Advantage, there can still be situations where out-of-pocket costs add up quickly, especially during major medical events.

This is why some people choose to add what’s often called “umbrella coverage.”

Umbrella coverage is not a replacement for Medicare, it’s an optional layer added on top of your base Medicare coverage.

Umbrella Coverage

What Is Umbrella Coverage?

Umbrella coverage is a general term for additional policies that help protect against specific, high-cost situations that Medicare may not fully cover.

These plans are designed to:

Help reduce large, unexpected expenses

Provide extra financial support during serious health events

Add peace of mind without changing your Medicare plan

Not everyone needs the same umbrella coverage — and some people don’t need it at all.

Common Types of Umbrella Coverage

Depending on health, budget, and risk tolerance, people may consider:

Hospital or Recovery Coverage

Helps with costs during hospital stays or recovery periods

Can provide cash benefits to help with deductibles, copays, or time off work

Cancer, Heart Attack, or Stroke Coverage

Designed to help with expenses related to major diagnoses

Can help cover things Medicare doesn’t, such as travel, lodging, or ongoing treatment costs

Dental, Vision, and Hearing Coverage

Medicare typically does not cover routine dental, vision, or hearing care

Some people add coverage separately for these needs

These options are often mixed and matched based on personal priorities.

How Umbrella Coverage Is Used

Umbrella coverage:

Sits on top of your Medicare coverage

Is optional, not required

Is chosen based on:

- Health history

- Budget

- Comfort with financial risk

The goal isn’t to “add everything” — it’s to fill the most meaningful gaps.

Why People Review This With an Advisor

Umbrella coverage decisions are very personal.

Most people want help understanding:

What gaps apply to their situation

Which coverages may or may not make sense

How to avoid overlapping or unnecessary policies

This is often reviewed after choosing a Medicare path, not before.

This is typically reviewed one-on-one.

A licensed Medicare advisor can help explain which umbrella options people commonly consider — and which they often skip.

Next, let’s look at prescription drug coverage (Part D) — another important piece that’s handled separately from most Medicare plans.

Part Six: Prescription Drug Coverage (Part D)

Prescription Coverage Is Handled Separately

Original Medicare (Part A and Part B) does not include prescription drug coverage.

That’s why most people also enroll in a Medicare Part D prescription drug plan.

Even if you don’t take medications today, understanding how Part D works is important.

How Part D Works (High Level)

Medicare Part D

Prescription drug plans are:

Offered by private insurance companies

Approved by Medicare

Separate from Part A and Part B

Chose based on your

- Medications

- Pharmacy

- Zip Code

Plans can change from year to year, which is why reviews are important.

Why Enrollment Timing Matters

If you go without prescription coverage when you’re eligible and don’t have other creditable drug coverage, Medicare may apply a late enrollment penalty.

That penalty:

Is added to your Part D premium

Can last for as long as you have Part D coverage

This is one of the most common — and most avoidable — Medicare mistakes.

Why Plans Vary So Much

Two people living in the same area can have very different Part D costs because:

Each plan has its own list of covered medications

Pharmacies have different pricing agreements

Copays and deductibles vary by plan

That’s why the “cheapest” plan isn’t always the best fit.

How People Typically Choose a Part D Plan

Most people choose a plan by:

Reviewing their current medications

Selecting their preferred pharmacy

Comparing plans available in their zip code

Enrolling in the plan that best fits their needs

Reviewing coverage each year during Medicare’s Annual Election Period

This process is usually quick — but accuracy matters.

Part D is one of the easiest things to get wrong.

A licensed Medicare advisor can help compare prescription plans based on your medications and pharmacy.

Finally, let’s clear up a few common myths and explain what happens if you choose to speak with an advisor.

Part Seven: Clearing Up Common Questions & What Happens Next

Let’s Clear Up a Few Common Medicare Myths

Before deciding what to do next, it helps to address a few things many people wonder about but don’t always ask.

“Do I have to pay to get help?”

No.

There is no fee to work with a licensed Medicare advisor.

You pay the same price for Medicare plans whether you enroll on your own or receive help from an advisor.

“Is there a catch if advisors are paid by insurance companies?”

No.

Advisors are paid directly by the insurance company after you enroll, but:

You are not charged extra

Advisors work with multiple companies

They are not paid more for one plan over another

The goal is education and proper enrollment — not pushing a specific plan.

“Will an advisor be biased toward one company?”

Independent Medicare advisors typically work with many insurance carriers, which allows them to:

Compare plans available in your area

Explain differences clearly

Help you choose what fits your needs

The choice is always yours.

What Happens If You Schedule a Call?

A Medicare review is simply a conversation, not a sales meeting.

On the call, you can expect to:

Review your Medicare situation and timing

Confirm which enrollment path applies to you

Compare options available in your zip code

Ask questions and get clear answers

There is no obligation to enroll in anything.

Many people schedule a call just to feel confident they’re doing things the right way

Ongoing Support (If You Choose It)

If you decide to work with an advisor, support doesn’t stop after enrollment.

Many advisors provide:

Help when your Medicare ID cards arrive

Assistance with billing or claims questions

Annual plan reviews to ensure your coverage still fits

Ongoing support as your needs change over time

This is one of the biggest reasons people choose guidance.

Ready When You Are

If you’d like help reviewing your situation or confirming your next steps, you can schedule a free Medicare review below.

Not ready yet? That’s okay.

You can come back to this guide anytime or reach out when you’re ready.